Your insurance coverage deductible quantity is something you will certainly determine with your insurance coverage representative or provider prior to completing your car insurance plan. What kinds of vehicle insurance policy deductibles are there?

Other coverages such as detailed, collision, personal injury protection and without insurance motorist residential property damage exist to assist cover injuries to those in your vehicle and damages to your automobile. These coverages might have deductibles, or at the very least the choice to consist of an insurance deductible to minimize the cost of insurance coverage.

g., telephone pole, guard rail, mailbox, building) when you are at-fault. While accident insurance coverage will not repay you for mechanical failure or typical wear-and-tear on your auto, it will cover damage from craters or from rolling your car (cheaper). The ordinary expense of accident insurance coverage is normally about $300 annually, according to the Insurance coverage Information Institute (Triple-I).

This consists of fire, flood, criminal damage, hail, dropping rocks or trees as well as various other threats, such as striking an animal. According to the Triple-I, the typical cost of comprehensive protection is generally much less than $200 per year.

This coverage is not readily available in every state, but it may have a state-mandated insurance deductible amount in those where it is. In the situations where a deductible uses, it is usually reduced, between $100 to $300. Injury defense, Relying on your state, you might have accident security (PIP) coverage on your policy (business insurance).

It can also help cover expenditures associated with lost earnings or if you need someone to do home tasks after an accident due to the fact that you can refrain so. Depending upon your state, you might have a deductible that applies if suing under this coverage. Numerous states with PIP deductibles offer several options to pick from, and also the deductible you select can impact your costs.

The Definitive Guide to Liberty Mutual Deductible Fund

Many companies use alternatives for $250, $500, $1,000 or $2,000 deductibles. Some auto insurer supply various choices for deductibles, including a $0 or $100 deductible. Your comprehensive as well as accident protections do not have to match, either; it is not unusual to have a $100 extensive insurance deductible however a $500 crash insurance deductible, or a $500 comprehensive insurance deductible as well as $1,000 crash insurance deductible.

Generally, the lower the deductible, the greater your insurance policy premium. It is important to consider your general monetary health when picking an insurance deductible. Aspects to take into consideration when picking an auto insurance policy deductible, There are several things to take into consideration when choosing your vehicle insurance policy deductible quantity. We have covered some of them below: Do you intend to pay much less View website for automobile insurance or repairs? A higher insurance deductible will usually decrease your insurance coverage premium, yet you will pay higher out-of-pocket prices if you sue for damage to your lorry.

You could invest extra on your costs by having a lower insurance deductible and also never finish up filing a case. Prior to you choose an insurance deductible, it is important to figure out what you can manage to pay if your vehicle is harmed in a crash. cheap.

If you do, you might not have the ability to pay for to repair your lorry if you are at fault as well as require to pay the deductible for repairs. Does your lender have insurance deductible needs? If your car is funded or leased, you will possibly need to lug thorough as well as collision coverages for your car.

Some lenders will have an optimum deductible that you are enabled to bring for comprehensive and accident. When are you not needed to pay your car insurance coverage deductible?

Your deductibles only use when suing with your insurer. If you have a lessening insurance deductible, Some insurer supply a diminishing deductible, or disappearing insurance deductible, option. If you have this policy feature, the longer you do without an accident causes a reduction in the amount you would certainly need to pay for your deductible.

Car Insurance Deductibles: How Do They Work? - The Motley ... - The Facts

So, as an example, if you have a $500 collision insurance deductible as well as do not have a mishap for 4 years, you could obtain a $100 reduction every year. Then, if you needed to submit a claim, your deductible would be $100 rather than the original $500. Once you utilize your lessening insurance deductible, there is generally a period to get it once again.

Often asked inquiries, What does it indicate when you have a $1,000 crash deductible? If you have a $1,000 deductible, you will pay $1,000 out of pocket if you have an authorized claim covered under accident. If you file an insurance claim for $5,000 worth of fixings, you will certainly pay $1,000 and the insurance coverage business will pay $4,000 - vehicle insurance.

Your physical injury liability as well as building damages obligation will pay for the problems to the various other event, as well as those protections do not have a deductible. However if you have collision insurance coverage as well as you want the insurance coverage business to step in to cover the fixings to your lorry, you will need to pay your collision insurance deductible.

If the mishap was the various other vehicle driver's fault, their liability insurance coverage ought to spend for your damages and also you must not need to pay an insurance deductible. insurance affordable. Nonetheless, if the other driver is uninsured or underinsured, you may be liable for paying an insurance deductible depending on just how your protection uses to cover the expenditures.

Your insurer will certainly pay for your problems, minus your deductible, as well as then ask the at-fault motorist's insurance firm to pay the money back in a process called subrogation. vans.

Your auto insurance deductible is generally a set quantity, state $500. If the insurance coverage insurer identifies your claim quantity is $6,000, and also you have a $500 deductible, you will certainly receive a claim repayment of $5,500. However, based on your deductible, not every auto mishap warrants a case. If you back right into a tree causing a small damage in your bumper, the price to repair it may be $600.

Rumored Buzz on Should I Have A $500 Or $1000 Auto Insurance Deductible

Deductibles differ by policy and motorist, and also you can select your automobile insurance policy deductible when you buy your plan.

Contrast quotes from the top insurance policy companies. Which Automobile Insurance Policy Protection Kind Have Deductibles?, there are differing deductibles based on those various types of coverage.

This insurance coverage spends for fixings to your lorry when you are at fault. auto. This might be when your vehicle is harmed in a mishap with an additional car or an item such as a tree or wall surface. This deductible is typically the highest insurance deductible you will certainly have with your automobile insurance plan.

Because case, you would certainly not pay a crash insurance deductible. Personal injury security coverage pays the clinical costs for the motorist and also all guests in your car. Without insurance motorist protection pays your expenses when you remain in an automobile accident with a motorist who is at fault but does not have insurance or is insufficiently guaranteed to cover your expenses - low-cost auto insurance.

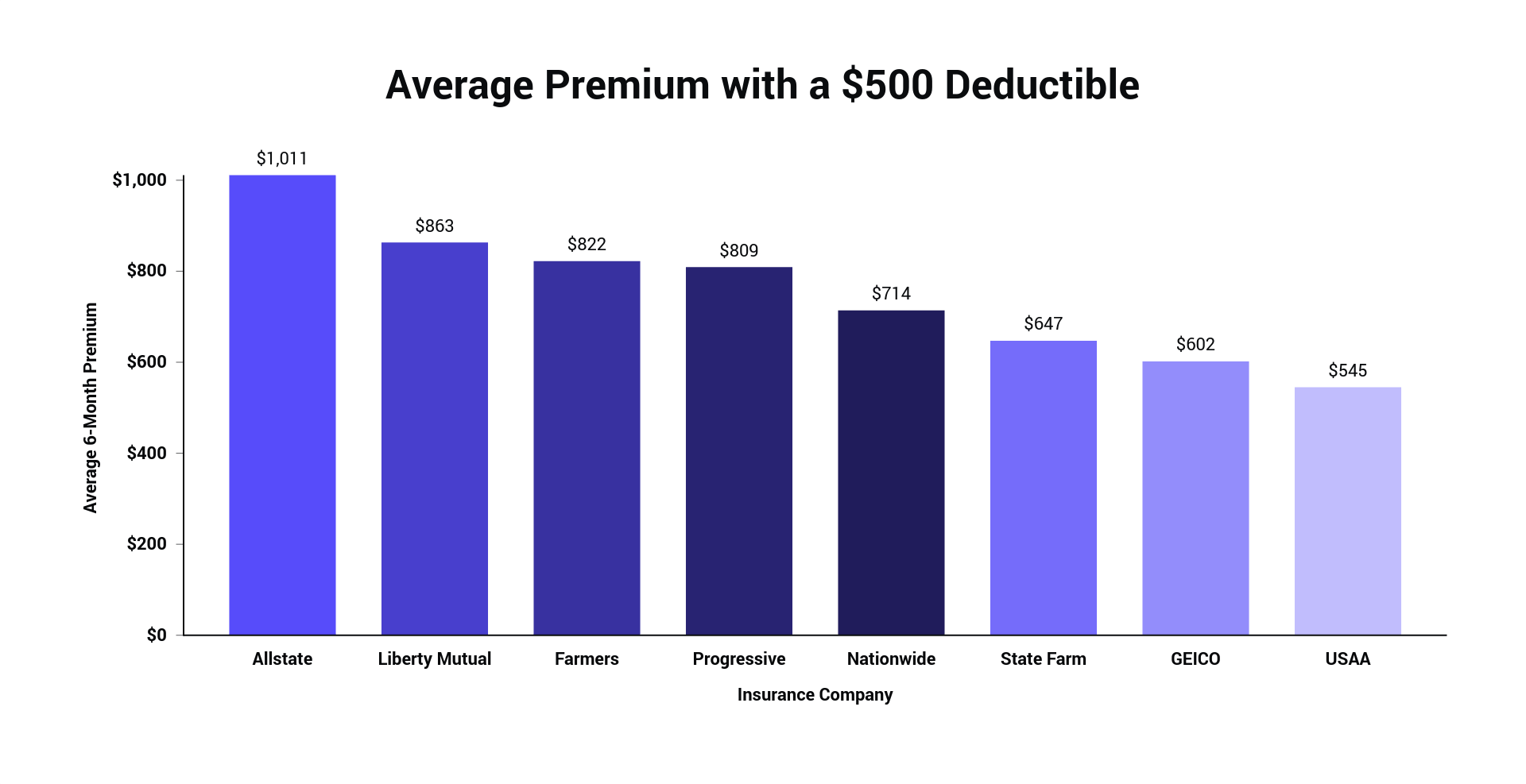

What Is the Ordinary Insurance Deductible Cost? Due to the fact that consumers select varying kinds of car insurance policy coverage with various financial limits, deductibles can differ substantially from one motorist to the next (cheap car insurance). For many vehicle drivers, normal insurance deductible amounts are $250, $500 as well as $1,000. According to Cash, Nerd's information, the typical car insurance coverage deductible quantity is around $500.

The What Is A Disappearing Deductible? - Mapfre Insurance Statements

Furthermore, your automobile insurance coverage deductible will differ based upon that protection and also the price of your costs. Usually talking, if you pick a plan with a greater insurance deductible, your premium will be reduced. This can be an excellent choice as long as you can pay that higher deductible in the occasion of a mishap (credit score).

As a matter of fact, you can save a standard of $108 per year by increasing your deductible from $500 to $1,000. For those with limited budgets, choosing a lower costs as well as a higher insurance deductible can be a method to ensure you can pay for your cars and truck insurance. If you can afford it, paying a greater costs could suggest you don't have to come up with a lot of cash money to pay a lower insurance deductible in the occasion of an accident.

It is essential to have your concerns pertaining to cars and truck insurance coverage deductibles answered before that occurs, so you know what to expect - credit. EXPAND ALLWho pays a deductible in an accident? Do you pay if you're not liable? When there's an automobile crash, the at-fault motorist is called for to pay the automobile insurance deductible.