If you can afford to pay of pocket if your car requires fixings or is taken, you'll probably intend to pull out of detailed insurance coverage. Vehicle drivers that can't afford to pay out of pocket will find thorough insurance coverage to be a far better investment (insure). Thorough insurance is also a smart financial investment if you live in a largely populated area.

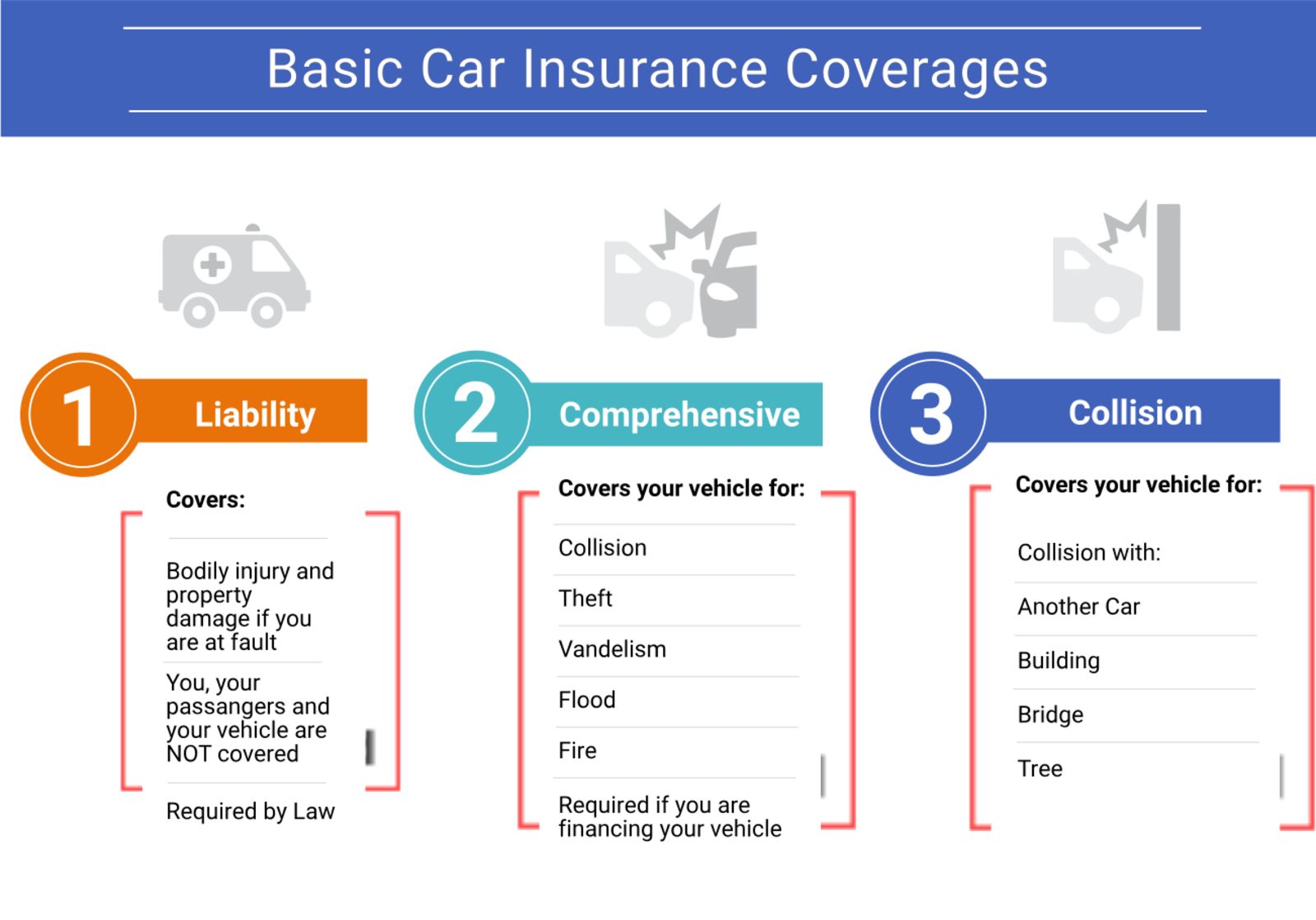

Vehicle lending institutions that need clients to purchase thorough insurance additionally need them to buy accident insurance coverage. low cost., you can not utilize crash insurance coverage to pay for: Medical costs incurred by other motorists in a crash, Damage created by vandalism, Replacing a taken car, Damages triggered by a crash with a pet, Losses from a mishap such as lost income, Comprehensive Coverage Purview, As Allstate points out, there's a restriction to comprehensive insurance coverage.

You might have the ability to discover even more details about this and comparable content at - low-cost auto insurance.

Price of Comprehensive Insurance policy Comprehensive covers damage to your auto triggered by mishaps and also catastrophes beyond car crashes. The average expense of thorough is approximately $134 per year, according to the Insurance Info Institute (insurers).

The Definitive Guide for Comprehensive Car Insurance: What Is It? - Liberty Mutual

perks insurance affordable cheap car insurance cheap car

perks insurance affordable cheap car insurance cheap car

Either way, you are looking at under $200 a month just for comprehensive insurance coverage for your cars and truck. If somebody thinks they're not likely to file a thorough insurance claim, yet they do not desire to bypass detailed insurance entirely, they might pick a reasonably high $1,000 insurance deductible to lower the premiums.

As well as thorough insurance may be pricey if you are buying it together with accident insurance. If your lorry is older as well as paid off, you can conserve cash by not acquiring detailed insurance coverage, specifically if burglary and also weather-related occasions are not worries where you live - insurance affordable. Pros Comprehensive coverage shields you against theft, weather-related events, as well as various other major points beyond your control (accident).

If you possess a new automobile as well as stay in a high-crime area, detailed insurance policy will cover the problems brought on by any kind of break-ins or thefts. Disadvantages Extensive insurance coverage does not damage brought on by a crash. It might not be needed to have for an older vehicle with high mileage. Detailed insurance coverage does not cover anything individual swiped from your automobile (prices).

Example of Comprehensive Insurance Comprehensive insurance policy functions comparable to any various other kind of vehicle insurance if you need to sue (car insurance). But if you have actually never had to do so, it assists to have a picture, so you understand what to anticipate. Below's an example of exactly how detailed insurance works if a chauffeur sues for automobile problems.

7 Easy Facts About Collision Versus Comprehensive Car Insurance - Alllaw Explained

One term that is often misconstrued is comprehensive cars and truck insurance. Several individuals think that thorough auto insurance policy is a comprehensive kind of insurance coverage that includes liability, crash, and extra (automobile).

cheap car affordable cheaper car insurance vehicle insurance

cheap car affordable cheaper car insurance vehicle insurance

This can affect your costs, as infractions and also mishaps are related to poor driving habits. As Discover more you can see, comprehensive and also collision insurance policy intends complement each other. That's why they are commonly advised with each other for a large range of defense. How Much Does Comprehensive Vehicle Insurance Coverage Expense? The Insurance Policy Details Institute (III) estimates the typical expense of detailed car insurance coverage to be around.

risks credit score liability cheaper car

risks credit score liability cheaper car

This way, you'll be able to inform which business are your leading selections for inexpensive vehicle insurance policy. Do You Really Required Comprehensive Cars And Truck Insurance? Roughly 77 percent of insured vehicle drivers have detailed coverage, according to the III. credit score. To help you make a decision whether to obtain this coverage or not, below are some inquiries you should ask on your own.

cheap auto insurance auto insurance auto insurance

cheap auto insurance auto insurance auto insurance

You will not require thorough insurance coverage if your vehicle is worth much less than your insurance policy deductible incorporated with annual coverage - auto insurance. Providers won't pay out even more than your vehicle deserves. If you abandon this insurance, nonetheless, make sure to establish cash aside for the cost of repairs or perhaps a new car - auto insurance.

Not known Incorrect Statements About Auto.pdf - Arkansas Insurance Department

insured car insured car insurers insurance

insured car insured car insurers insurance

The threat of all-natural disasters is an additional reason to obtain this protection (insurance affordable). Floods and twisters can conveniently create severe damages to your automobile as well as even complete it if you live in locations susceptible to them. Your automobile may be much more in jeopardy if you tend to park it on the street rather than in a garage.

One of the earliest automobile insurance firms on the list, Erie supplies a great detailed car insurance plan that covers vandalism, storms, dropping things, animal-related damage, as well as windshield splits and chips. Various types of burglary are also included in this plan, consisting of automobile burglaries and taken cars and trucks (insurance companies). In some states, basic auto rental coverage is immediately included with your thorough cars and truck insurance policy.

Make certain to examine the great print of your policy or call your agent to discover if this relates to you. Farmers thorough insurance is rather basic. It covers theft, criminal damage, fire, weather-related events, and also crashes involving animals. Your insurance coverage prices will be established by the kind of car and also loss history.

Insurance coverage isn't expanded to accident with objects if you're liable for a vehicle accident. In a protected mishap, this insurance policy can be expanded past your own vehicle to include momentary substitute lorries, brand-new vehicles, and automobiles in use that aren't possessed by a member of your house (cheap auto insurance).